Financial Sector

Emerging digital technologies have encouraged the development of new products and services, and it’s forcing companies to redesign their business model in order to be competitive and ultimately be more successful.

We can develop a marketing and communication strategy that makes use of these emerging technologies making them accessible to your customers or members and increase business opportunities.

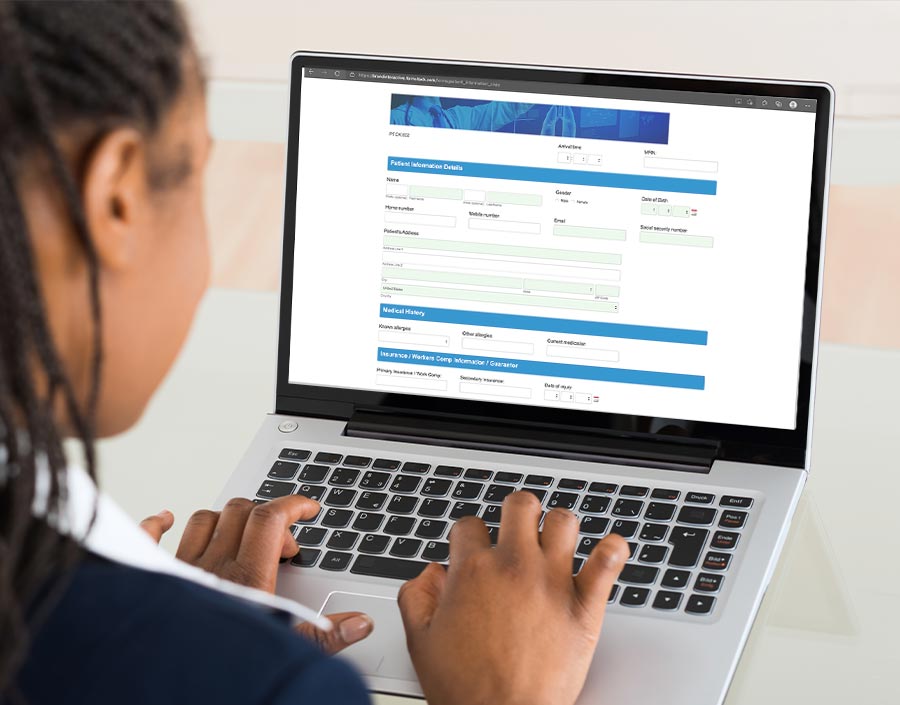

This shift has necessitated a change in marketing and communication strategy, as customers habits have changed, the adoption of online services has increased during the 2021 COVID-19 pandemic and there is an increased expectation for digitalized services in the financial sector to satisfy:

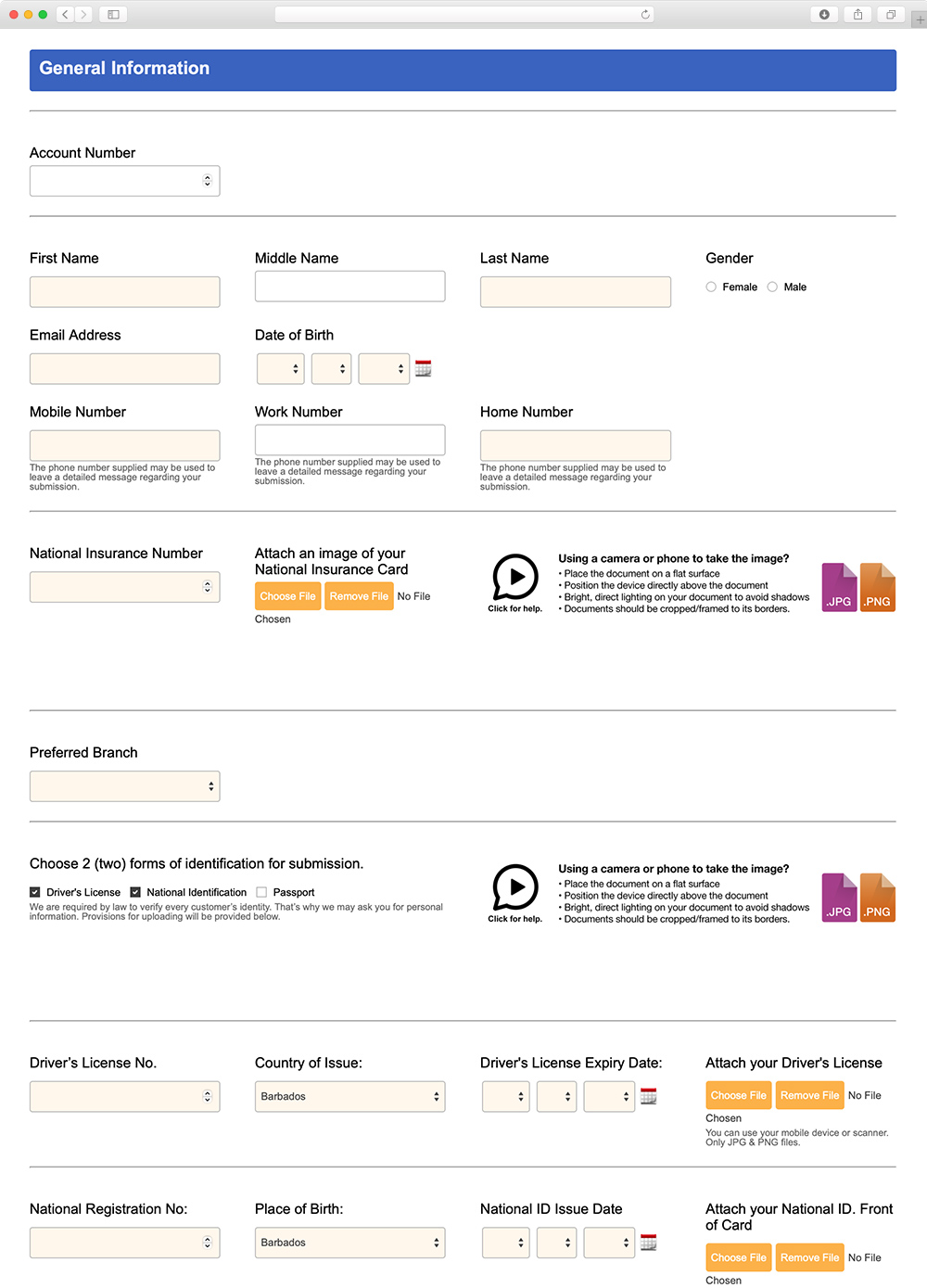

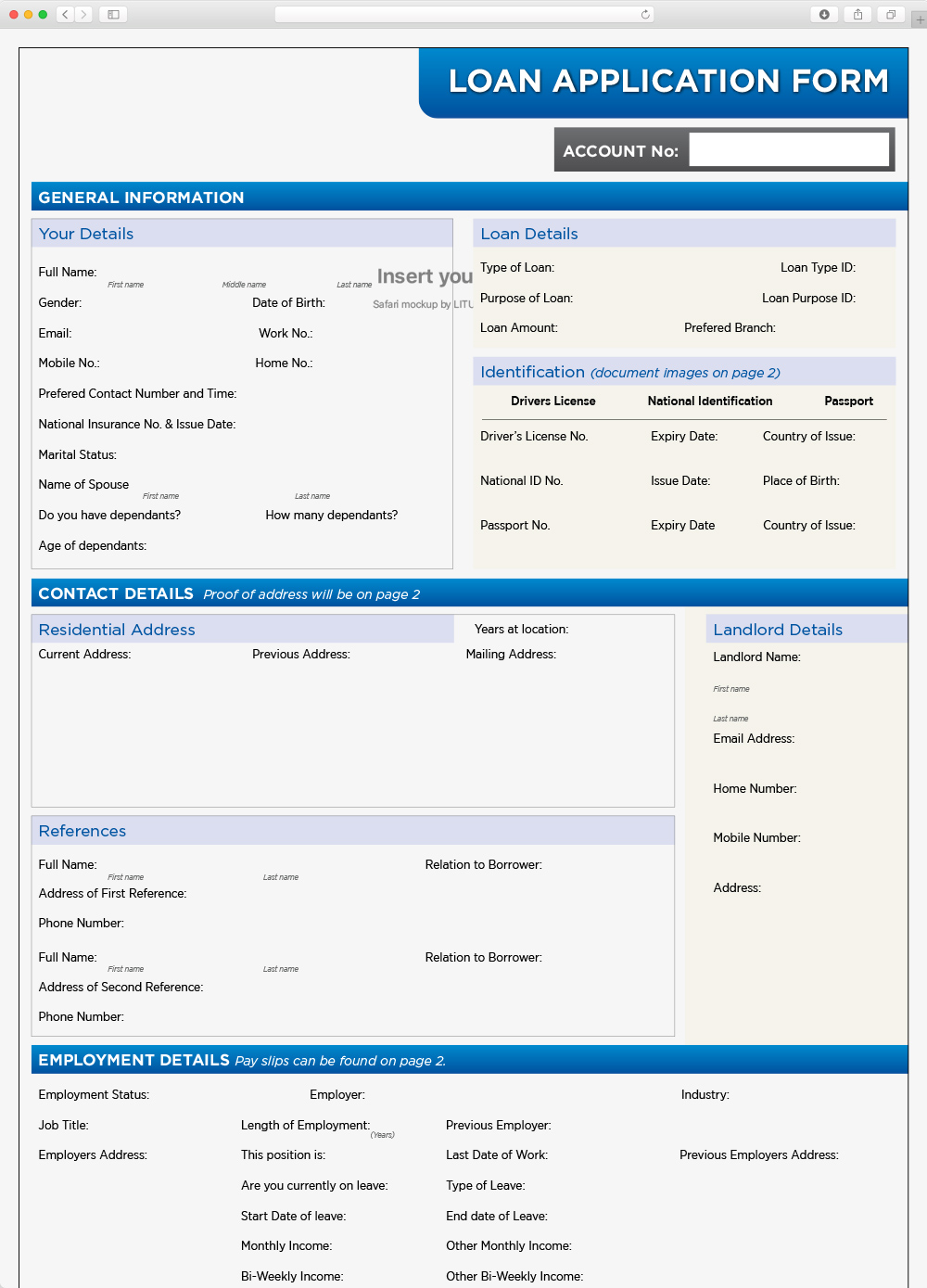

- Online Loan Application

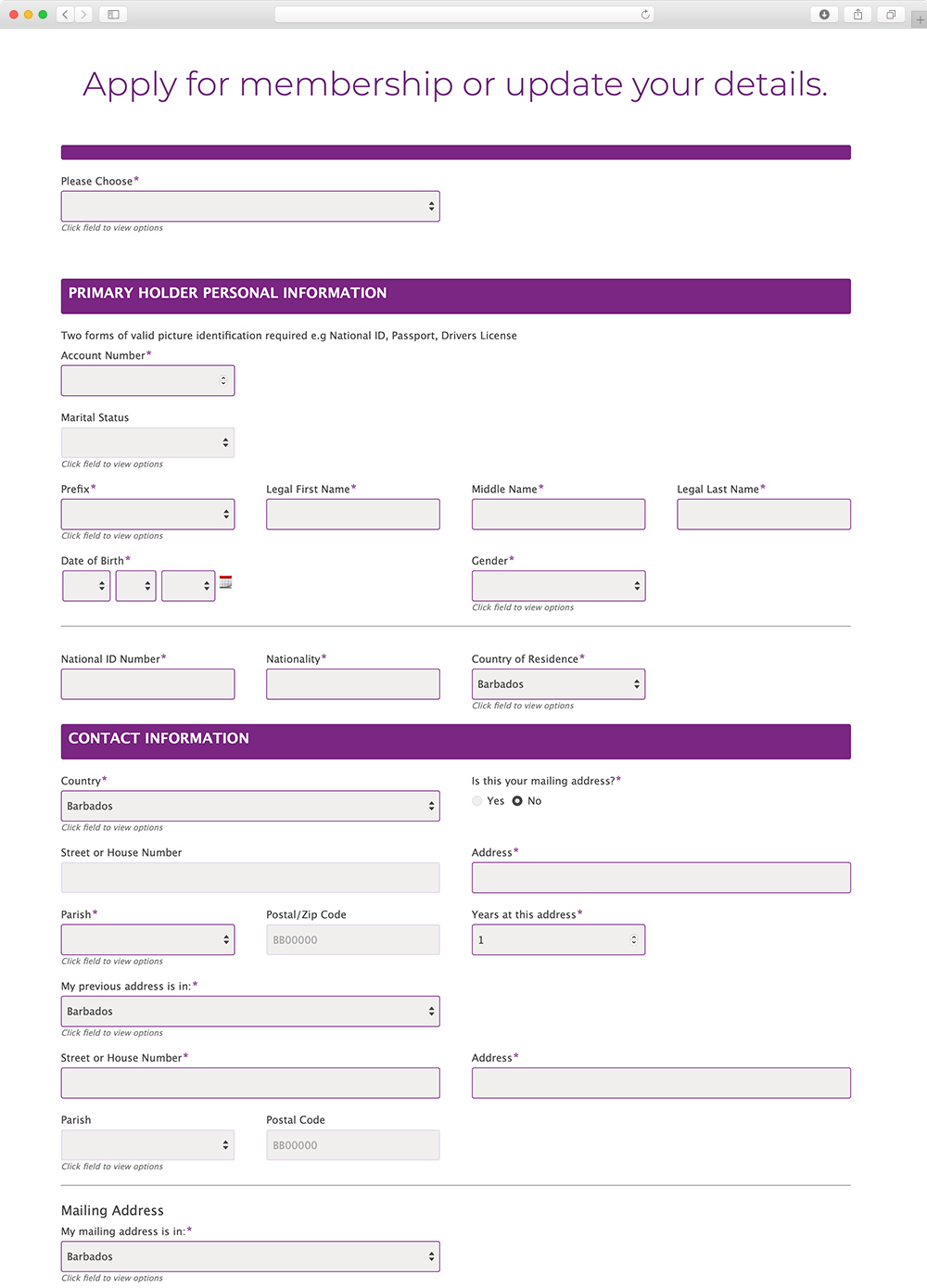

- Membership Application

- General Information updates satisfying KYC and FATCA requirements

- Account Application

Our Approach

Develop a well formed strategy to seamlessly integrate with your marketing channels and internal workflows, revitalizing traditional methods delivering an innovative end-to-end workflow, effectively satisfying users expectations, needs and interests resulting in increased customer or member acquisition and loan growth, to name a few.

Digital financial workflows that keep your team organized and productive.